Happy New Year!

Last week I had a very interesting conversation with a prospective buyer. The client owns a house in Chevy Chase and does not have to sell before buying a new house. Her goal is to move a little closer in – Edgemoor, if possible – or just on the outskirts of Edgemoor, jokingly referred to by some as “Edgeless.” Towards the end of our conversation, she said something that stuck with me “Too many Realtors, too few houses.” I thought that was brilliant! In one short sentence, this savvy local buyer summarized what we all experienced in 2017 – a year of shrinking inventory. This trend is feeding on itself. With fewer choices, more would-be-sellers stay in place, avoiding putting their homes up for sale until the “One Perfect House” becomes available. Other would-be-sellers who must sell their existing home before buying the next are paralyzed by fear of not finding the right home to buy, which causes them to take the “hold and wait” approach.

But wait, there’s more! Those who look to downsize find themselves in a bind where the equity and overall market value in their existing home is simply not enough to “downsize” to a reasonably priced condo with ample living space and affordable monthly condo fees. For this would-be-seller, moving is not an option, so they make adjustments to age in place and delay moving out of their home for a few more years, maybe even a decade or two. (Notice how I didn’t address the second part of the buyer’s statement “too many Realtors” yeah, I’m not going there!)

This brings me to “The Tax Cuts and Jobs Act” of 2017 that was signed into law before Christmas and the impact this may have on the real estate market in Maryland and Washington DC. The new law limits the state income tax and real estate property tax deductions to $10,000 annually per household. Some critics of the new law charge that this may have real consequences, as buyers weigh the total financial impact of “moving up” to a larger, more expensive home. I personally believe that for the majority of buyers in our specific market, this particular aspect of the new tax law will not have a significant impact on buyers’ motivation to buy given the totality of the strength of the local economy led by steady high paying jobs.

Last factor to keep an eye on in 2018 is interest rates. By all accounts, interest rates will go up in 2018, some predict by a point. If done gradually (1/4 point per quarter), we may see a spike in buyers‘ activity periodically. But overall, with rising interest rates and as buyers have less “buying power,” sellers may see a squeeze on home prices and a downward pricing pressure.

BUT it’s 2018 – a new year, a new beginning – and along the very long list of things we’re hoping for, we’re also wishing for a shift in the trend described above. The real estate market is a critical economic engine for any jurisdiction. It’s a job creator and a major government revenue source. When the housing sector suffers, other sectors of the economy feel the pain and local government budgets are affected.

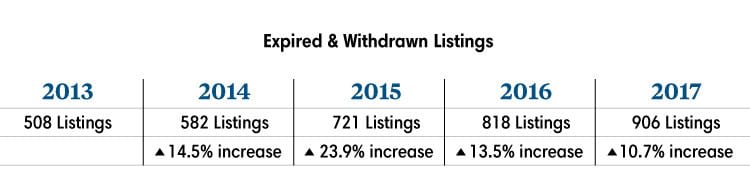

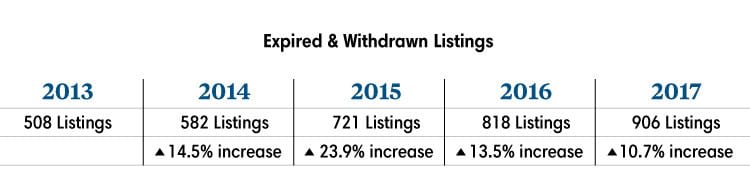

Let’s get to some numbers and see how we did in 2017 compared to previous years. Every quarter when I sit down to write the report, I try to come up with new details, interesting stats that may be very telling but overlooked. This time I examined the Expired and Withdrawn listings from the market and what I found was very surprising, even to me. The number of Expired and Withdrawn listings in Bethesda and Chevy Chase has almost doubled in the last 5 years! In 2013, it was 508, while in 2017, it jumped to 906. At face value, this number represents sellers that entered the market with high hopes, only to pull the plug following disappointing results. Some came back with another price at a later time and have indeed sold; some took a longer break. This significant increase is very telling of sellers’ expectations versus reality and how the two may not mesh.

Let’s take a further look at the past five years as a whole before diving into the various zip codes.

All of Bethesda and Chevy Chase:

(all types of properties, all price ranges)

In 2017 there were 1,679 contracts with an average of 64 Days on Market. In 2016, fewer properties sold with a slightly lower DOM. The graph below illustrates the changes over the last 5 years.

We will now look at specific zip codes, but before we do that, I have to again state that real estate is very local. The stats I bring you here cover large areas, often including locations (specific sub-markets) that, if looked at specifically, would show different behavior patterns. With that in mind, lets get going.

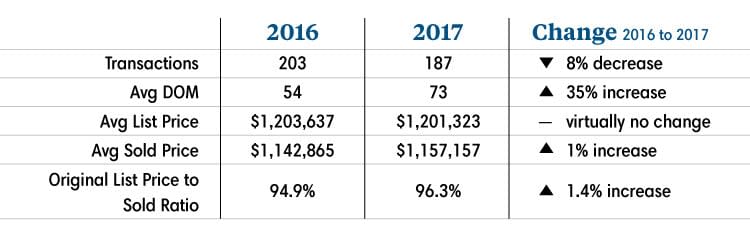

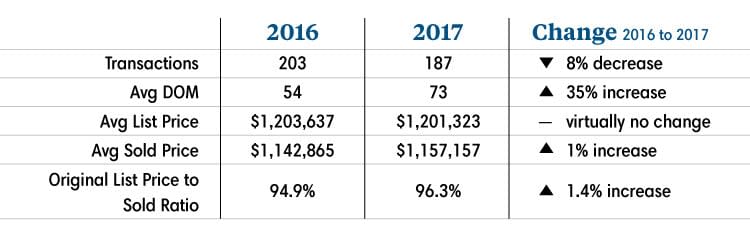

Detached Homes in 20814:

In 2017 there were 187 transactions (ratified contracts and sales), compared with 203 in 2016, nearly an 8% drop in transaction volume. Days on Market (DOM) increased by 35% to 73 days on average, while the Original List Price to Sold Price Ratio (LP/S%) improved slightly from 94.9% in 2016 to 96.3% in 2017.

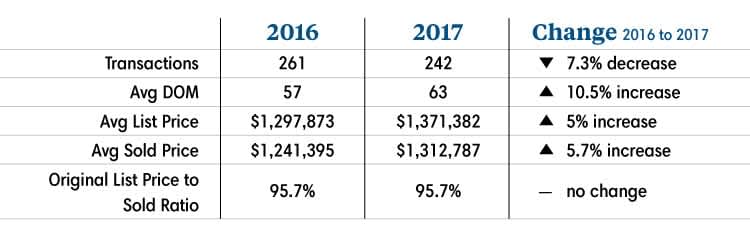

Detached Homes in 20815:

Here, as well, there were less transactions in 2017, dropping to 242 contracts from 261 in 2016. That’s a 7.3% decrease. DOM went up slightly from 57 days on average in 2016 to 63 daysin 2017. On the flip side, the average Sold Price was $1,312,800, an increase of 5.7% from that of 2016. Original List Price to Sold Price Ratio (LP/S%) stayed virtually the same at 95.7%.

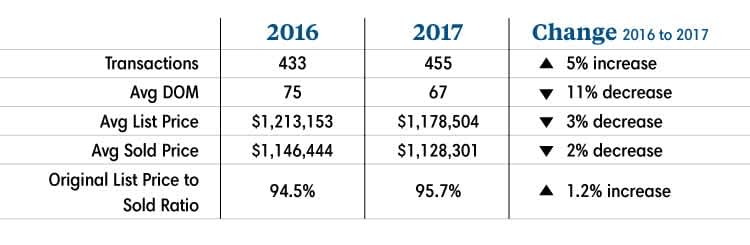

Detached Homes in Zip 20817:

A reverse of the trends in the other zips, whereby 455 homes went under contract in 2017, a 5% increase from 2016. Also, Days on Market decreased from 75 days on average in 2016, to 67 in 2017. The Original List Price to Sold Price Ratio (LP/S%) improved by 1.2% and averaged 95.7% in 2017.

As far as the condo market goes, the variety of locations, price ranges, branding, and amenities compelled me to focus on a more defined area and price range.

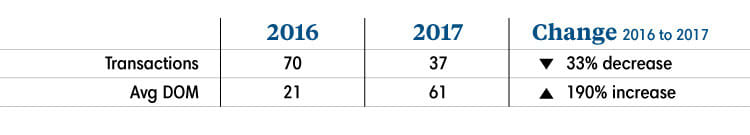

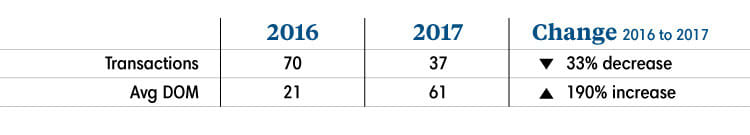

Condos In 20814:

For condos and townhomes priced $750,000 and above, 2017 was a bit of a challenging year with a total of 37 contracts compared with 70 in 2016, a dramatic 33% drop! Moreover, the average DOM almost tripled to 61 days compared with 21 days on average in 2016, a 190% increase.

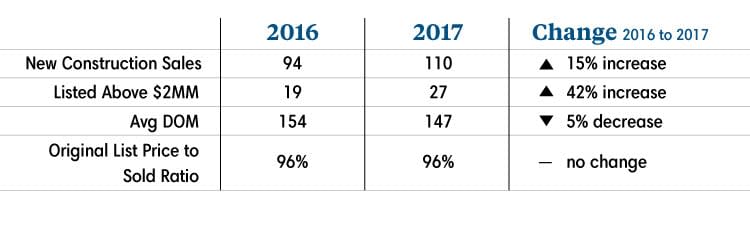

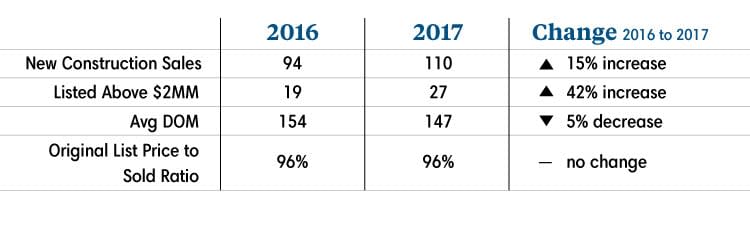

New Homes in Bethesda-Chevy Chase:

This segment continues to grow despite some of the difficulties described by homebuilders – rising competition, rising acquisitions costs, increasing regulatory restrictions and taxation, and of course, increased buyer scrutiny. In 2017 there were 110 sales of newly constructed homes (2016 and 2017 construction). This number does not include custom homes. That’s an increase of nearly 15% from 2016 sales. Of the 110 homes, 27 were listed above $2.0MM compared with only 19 in 2016, a 42% increase of inventory in this price category. Average Days on Market decreased slightly from 154 to 147 days. The Original List Price to Sold Price Ratio (LP/S%) has stayed the same at 96%. By the way, we’re proud to say that the highest priced new home to sell in 2017 was our own listing at 9 Darby Ct, listed for $3,850,000 and sold for $3,795,000.

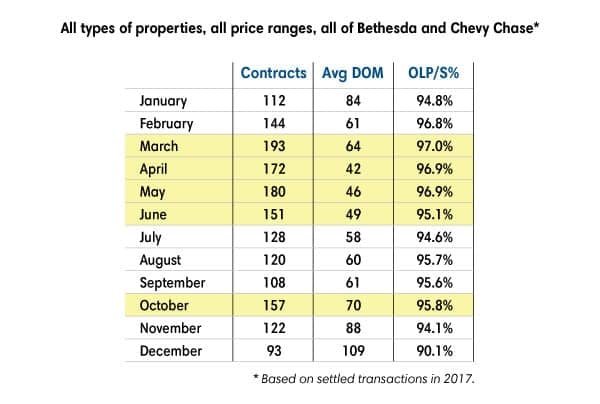

Before we sign off, I am often asked, “When is the best time to sell?” While there’s no definite answer to this question, as it all depends on circumstances from the stock market to the weather, competition, interest rates, what a certain President may or may not do, etc., there are trends that can be tracked and offer a general guideline. According to the 2017 data, the months with the most transactions were March, May, April, October and June, in that order.

I want to thank you for reading and also wish you all the best for 2018! As always, if you have any real estate needs, please do not hesitate to reach out. It will be my pleasure to offer my guidance and services and tailor a plan that fits you, your home, and your goals.

All the best