Happy New Year! We hope this letter finds you and your family well. Another adventurous year has gone by; some would say tumultuous! Between the war in Ukraine, rising inflation, nail-biting midterm elections, and tumbling stock markets, it’s almost easy to forget that 2022 also brought us some exciting, positive events. We enjoyed mind-blowing images from far away galaxies taken by NASA’s James Webb space telescope, we cheered for one of the most exciting futball/soccer World Cups in recent history (Go Argentina!), and we returned to world-wide travel (mostly) without concerns about Covid-19 restrictions.

Unprecedented Streak of Property Appreciation Slows Down:

In the real estate world, 2022 also marked a great and rapid tidal shift in a continuous 2-year market rally, which brought about the largest and most significant value appreciation in this century. The median sold price of detached homes during Q1 2020 in Bethesda-Chevy Chase was $1,155,000. Fast forward to Q1 2022, the median sold price of detached homes in B-CC jumped to $1,545,000, a whopping 33.8% increase!

Then came news of rising inflation – over 8% annually adjusted – fueled by ongoing supply chain challenges and Russia’s war on Ukraine, which wreaked havoc on oil prices world-wide. The Federal Reserve’s response was a sharp rise of its benchmark interest rate; by December 2022, it was the highest in 15 years. The action by the Federal Reserve in 2022 is the most aggressive since the 1980s.

The unwelcomed news of rising mortgage interest rates had an immediate effect on homebuyers, ultimately slowing down the aggressive Sellers’ Market. I have addressed the causes and effects of these economic changes in my Q2 and Q3 market reports, where I labeled them “a stabilization period.” Not a crash, not a bubble, but rather a period whereby prices will stabilize and a more balanced relationship between the supply of homes and demand by buyers.

One interesting statistic that best illustrates the changes in our market during 2022: Detached homes in B-CC sold between January and April 2022 (time of contract), on average yielded 107.9% Sold to List Price Ratio. In other words, these homes sold for 7.9% higher than the advertised asking price. Homes that sold between May and December, however, on average earned 102% Sold to List Price Ratio, only;2% above the asking price. Timing in the market represented a spread of nearly 6%!

Notice that, on average, sellers are still getting their asking prices, or slightly above. Some sellers have undoubtedly had to cut back on price expectations; however, generally speaking, the low availability of homes in our market continues to be the leading, most dominant factor, eclipsing buyers’ worries over high-interest rates �and inflation.

Market Forecast for 2023:

Looking ahead to likely trends in 2023, the biggest driving factor will continue to be the lack of inventory of detached homes in the neighborhoods of Upper NW DC, Chevy Chase, and Bethesda. There are two underlying reasons: one is the ongoing trend among the Baby-Boomer generation who are “aging in place.” Rather than downsize, they make minor improvements to enable them to stay in their homes longer. And with life expectancy on the rise, the immense inventory of homes owned by this older generation in the suburbs of Bethesda-Chevy Chase, Upper NW DC, and Potomac is not entering the market. The second is a new and emerging factor: the many thousands of homes that were purchased since 2015 in our region which were secured by mortgages averaging well below 4% fixed rates. In fact, according to recent data released by lenders, 67% of homeowners in the United States have mortgages with secure rates in the 2% and 3% range. These homeowners are going to be very reluctant to make a move, as they would give up historically low-interest rates to take on new, more costly mortgages. For many, the financial implications would render such a move ill-advised. And so, while during “normal” market conditions we expect a decent portion of homeowners to move every 5-10 years (move up, move down, or move away), given the rapid shift in the economics, we now expect most to remain longer in their homes, translating to an even tighter inventory.

Barring major economic events such as a deep and long recession, our market will mostly maintain current values and annual appreciation will return to its normal rate (likely in the low single digits), even though some buyers will remain on the sidelines.

The Tale of Single Family Home Prices:

As in every year, we keep track of stats that tell the tale of our market as it relates to affordability. In previous years, we examined the availability of homes priced under $700,000. This year we moved the benchmark to $1 Million. In Bethesda-Chevy Chase, the number of detached homes listed for sale under $1 Million in 2020 was 438, in 2021 there were 341, and in 2022 only 214. In two years, this segment of the market shrunk by more than 50%. As for the other end of the spectrum, the number of detached homes listed over $3M in 2020 was 48. This number jumped to 85 in 2021 and further increased to 95 in 2022, nearly doubling in 2 years.

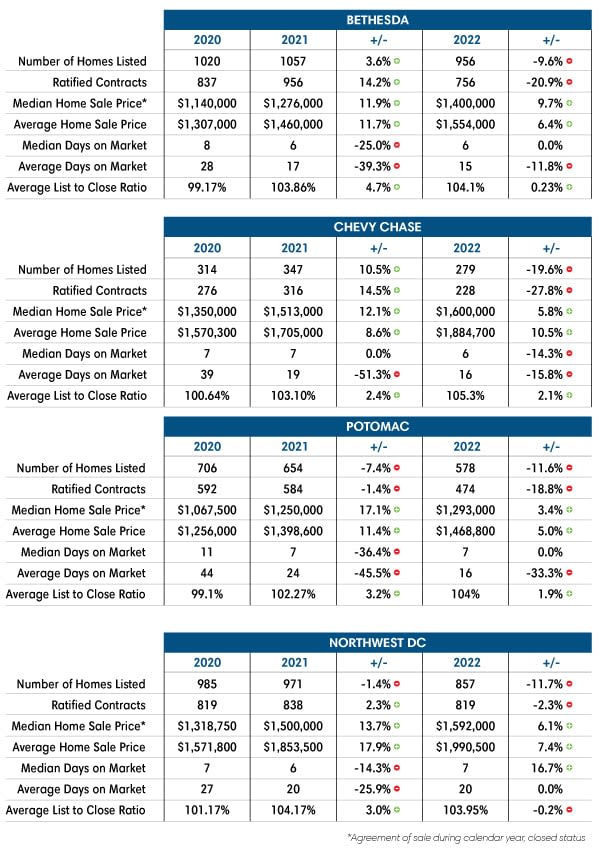

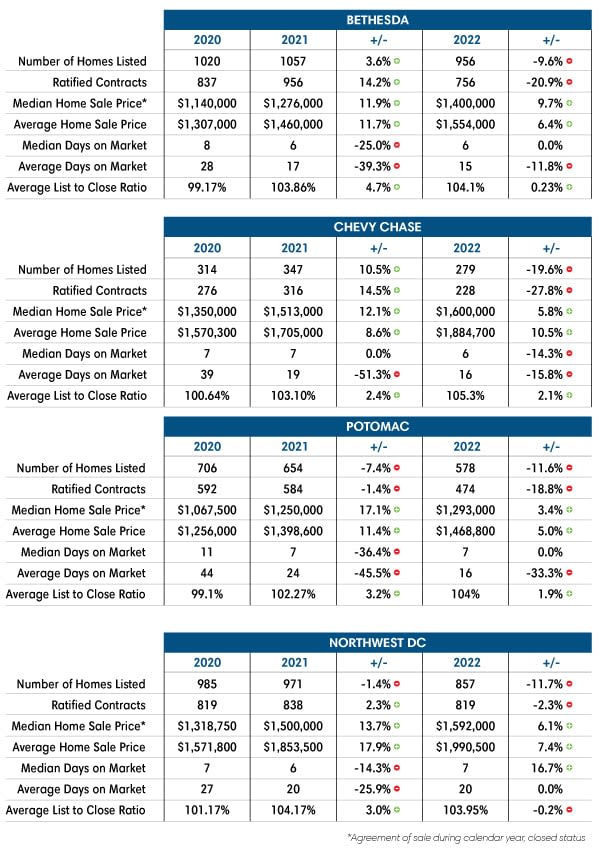

Let’s look more closely in the charts below at other indicators of single family home sales for 2022, as they compare to the last two years:

Key Takeaways:

Key Takeaways:

There was a significant drop in the number of listings entering the market in 2022 compared with 2021, with nearly 10% fewer homes in Bethesda and almost 20% fewer homes in Chevy Chase. At the same time, the number of ratified contracts also saw a dramatic decrease, with roughly a 21% drop in Bethesda and a nearly 30% drop in Chevy Chase. The change took hold in the April/May timeframe as interest rates began to climb and buyers hit the brakes. Despite the slowdown, 2022 can still be summarized as a strong sellers’ market. Median and average home prices rose between 5% and 9% in the four markets, as illustrated above and the key indicator of Average Close Price to List Price Ratio increased modestly across the region compared to 2021. Lastly, the Days on Market (DOM) indicator has largely stayed the same.

In Closing:

I hope you enjoyed reading this real estate market report – it is a labor of love! If you are interested in an analysis of a specific segment of the market or would like to discuss your personal real estate needs, please do not hesitate to reach out. It would be my pleasure to offer my guidance and services and tailor a plan to your goals.

All the best in the New Year

Key Takeaways:

Key Takeaways: