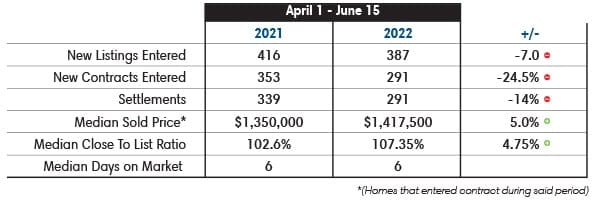

Q2 2022 Market Report

Market Reports Avi Galanti

Market Reports Avi Galanti

Diego Sito

The property tax code in DC and MD has some notable differences.

Market Reports

Avi Galanti

The first half of 2025 unfolded against a backdrop of steady economic growth, easing inflation, and cautious optimism from both buyers and sellers. Mortgage rates, whi… Read more

Karen Galanti

Montgomery County Public Schools (MCPS) is undergoing a major review of its middle and high school boundaries — and big changes could be coming that affect where thous… Read more

Matthew Klein

With the weather becoming warmer and warmer, it is time to talk golf… Montgomery County offers a diverse array of public golf courses that cater to players of all skil… Read more

Kris Feldman

For many adults 65+, the idea of downsizing comes up as life shifts and priorities change. The children are grown, the rooms are quiet, and the upkeep feels endless. A… Read more

Every presidential transition brings significant shifts to DC’s luxury housing market, and this cycle is no exception.

Diego Sito

Adams Morgan is one of Washington, DC’s most dynamic and diverse neighborhoods, known for its eclectic mix of historic row houses and bustling nightlife. This area, wi… Read more

Market Reports

Avi Galanti

Welcome 2025, and Happy New Year to all! As we begin a new year, it’s hard to believe that the first quarter of the 21st century is already behind us. 2024 was a year … Read more

Avi Galanti

Montgomery County has recently sent out property tax assessments for the next three years (2025-2027). The fiscal year in MoCo begins on July 1, 2025, and property tax… Read more

Bringing together a team with the passion, dedication, and resources to help our clients reach their buying and selling goals. With you every step of the way.